And because some SDIRAs such as self-directed standard IRAs are matter to required minimum distributions (RMDs), you’ll need to prepare forward making sure that you have adequate liquidity to satisfy The principles established because of the IRS.

Better Costs: SDIRAs frequently come with better administrative fees in comparison to other IRAs, as sure areas of the administrative system can't be automatic.

Irrespective of whether you’re a economic advisor, investment issuer, or other financial Specialist, explore how SDIRAs may become a robust asset to expand your business and accomplish your professional goals.

The leading SDIRA guidelines through the IRS that buyers need to comprehend are investment constraints, disqualified folks, and prohibited transactions. Account holders should abide by SDIRA rules and regulations as a way to protect the tax-advantaged standing in their account.

Adding cash straight to your account. Remember that contributions are issue to annual IRA contribution boundaries set through the IRS.

Just before opening an SDIRA, it’s imperative that you weigh the possible benefits and drawbacks determined by your precise economic aims and danger tolerance.

Limited Liquidity: Lots of the alternative assets that may be held within an SDIRA, for instance property, personal fairness, or precious metals, might not be quickly liquidated. This may be a problem if you'll want to access money promptly.

No, you cannot put money into your individual business using a self-directed IRA. The IRS prohibits any transactions involving your IRA and your very own small business as you, as the operator, are considered a disqualified individual.

IRAs held at financial institutions and brokerage firms offer you confined investment alternatives to their consumers as they would not have the know-how or infrastructure to administer alternative assets.

The tax benefits are what make SDIRAs beautiful For most. An SDIRA might be both equally traditional or Roth - the account form you end up picking will depend mostly on the investment and tax approach. Examine using your fiscal advisor or tax advisor in case you’re Not sure that's ideal for you personally.

In contrast to shares and bonds, alternative assets will often be more challenging to market or can have rigorous contracts and schedules.

Number of Investment Solutions: Make sure the service provider makes it possible for the types of alternative investments you’re thinking about, including real estate property, precious metals, or non-public fairness.

Imagine your Good friend might be starting another Fb or Uber? With the SDIRA, you could invest in triggers that you suspect in; and probably delight in greater returns.

Occasionally, the charges connected with SDIRAs is often increased and even more sophisticated than with an everyday IRA. It's because from the amplified complexity affiliated with administering the account.

Generating one of the most of tax-advantaged accounts helps you to maintain far more of the money that you simply spend and generate. According to whether you select a standard self-directed IRA or perhaps a self-directed Roth IRA, you've got the potential for tax-cost-free or tax-deferred development, provided specified situations are fulfilled.

Therefore, they have a tendency not to market self-directed IRAs, which supply the flexibility to speculate in a broader range of assets.

Being an click to investigate Trader, even so, your choices are usually not restricted to shares and bonds if you end up picking to self-immediate your retirement accounts. That’s why an SDIRA can transform your portfolio.

In the event you’re searching for a ‘set and overlook’ investing method, an SDIRA almost certainly isn’t the proper option. Because you are in full Regulate above every investment built, It truly is up to you to execute your own personal due diligence. Recall, SDIRA custodians usually are not fiduciaries and can't make suggestions about investments.

Complexity and Accountability: With the SDIRA, you may have much more Regulate more than your investments, but You furthermore mght bear much more duty.

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Hailie Jade Scott Mathers Then & Now!

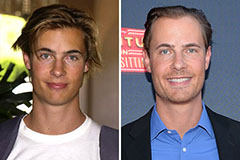

Hailie Jade Scott Mathers Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now!